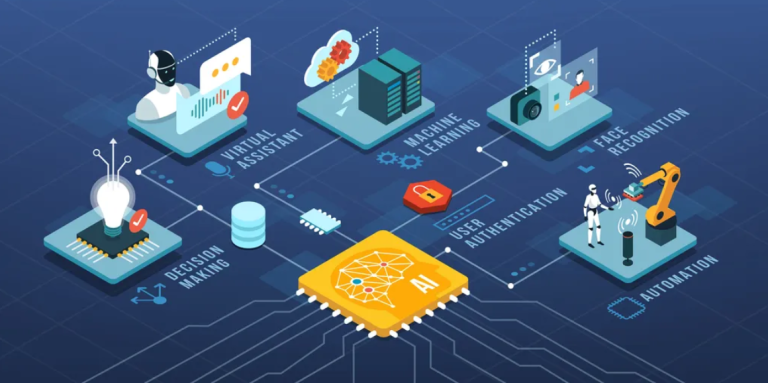

When it comes to securing your financial future in retirement, choosing the right investment funds is essential. With a plethora of options available, it can be overwhelming to select the right funds for your retirement portfolio. In this article, we’ll explore a variety of fantastic retirement funds to help you make informed investment decisions and ensure a prosperous retirement.

- The Importance of Retirement Funds

Retirement funds, such as 401(k)s and IRAs, are long-term investment vehicles designed to provide financial security during your retirement years. Selecting the right funds can significantly impact the growth of your retirement nest egg.

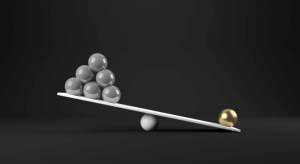

- Consider Your Risk Tolerance

Before diving into specific funds, it’s crucial to assess your risk tolerance. This helps determine the right balance of assets in your retirement portfolio. While younger investors may tolerate higher risk, those closer to retirement should prioritize capital preservation.

- A Diverse Mix of Retirement Funds:

Target-Date Funds: These funds are designed to align with your expected retirement date. They automatically adjust the asset allocation, becoming more conservative as you approach retirement. Examples include Vanguard Target Retirement Funds and Fidelity Freedom Funds.

Index Funds: Low-cost index funds, such as those tracking the S&P 500, provide broad market exposure and are excellent for long-term growth with low fees.

Actively Managed Funds: Some investors prefer professional management. Funds like T. Rowe Price Equity Income Fund (PRFDX) provide active management that aims to outperform the market.

Dividend Funds: Dividend-focused funds, like the Vanguard Dividend Growth Fund (VDIGX), invest in companies with a history of dividend growth. These can provide both income and capital appreciation.

Real Estate Investment Trust (REIT) Funds: For diversification, consider REIT funds like Vanguard Real Estate Index Fund (VGSLX). REITs offer exposure to the real estate market and often provide attractive dividends.

International Funds: Diversifying globally is essential. Funds like the American Funds EuroPacific Growth Fund (AEPGX) focus on international stocks for potential growth.

- Analyzing Fees and Expenses

Low expenses are crucial for maximizing your returns. Be sure to review the expense ratios of funds you’re considering. Index funds and ETFs typically have lower fees compared to actively managed funds.

- Staying Informed and Rebalancing

Regularly review your retirement portfolio to ensure it aligns with your goals. Rebalancing may be necessary to maintain your target asset allocation.

- Seek Professional Guidance

If you’re uncertain about which funds best suit your retirement goals, it’s wise to seek advice from a financial advisor. They can provide personalized guidance based on your unique financial situation.

- Tax Considerations

Different retirement accounts (e.g., traditional vs. Roth IRAs) have distinct tax implications. Be aware of these differences and how they may affect your retirement income.

- The Magic of Compounding

Remember that time is your ally when investing for retirement. The earlier you start, the more time your investments have to grow through the power of compounding.

- Review and Adapt as Needed

Life circumstances change, as do financial markets. Regularly review and adapt your retirement portfolio to reflect these changes.

Choosing the right retirement funds is a pivotal step in securing your financial future. Diversification, low costs, and alignment with your risk tolerance and retirement goals are all crucial factors. The featured funds are just a sample of what’s available; you have many options to explore. By carefully considering your choices and staying informed, you can ensure that your retirement funds grow into a bumper crop that provides for a fantastic retirement. Remember, it’s never too early to start, and every year of savings brings you one step closer to financial security in retirement.