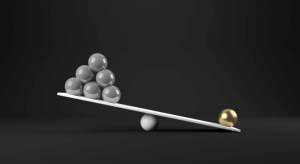

Selecting the right mutual fund is a crucial step in building a diversified and profitable investment portfolio. With a plethora of options available, choosing the right funds can be a daunting task. In this article, we will delve into five top-rated mutual funds, each with a five-star Morningstar rating, making them suitable choices for investors of all backgrounds and risk appetites. Whether you’re seeking growth, income, or a combination of both, these funds offer a compelling array of features and benefits.

- Vanguard 500 Index Fund (VFIAX)

Morningstar Rating: ★★★★★

The Vanguard 500 Index Fund is a stalwart in the world of index funds, and its stellar Morningstar rating speaks to its consistent performance. This fund is designed to mirror the S&P 500 index, which includes some of the largest and most influential U.S. companies. Key benefits of VFIAX include:

- Low Expenses: VFIAX boasts a low expense ratio, making it an extremely cost-effective investment choice.

- Diversification: With 500 holdings covering various sectors, this fund offers diversification and a low level of company-specific risk.

- Passive Investing: The fund’s passive management style aligns with a long-term investment approach, making it suitable for investors who prefer a “buy and hold” strategy.

- T. Rowe Price Equity Income Fund (PRFDX)

Morningstar Rating: ★★★★★

For investors seeking income with the potential for growth, the T. Rowe Price Equity Income Fund is an appealing option. This fund focuses on dividend-paying stocks and has a history of providing consistent income to investors. Key benefits of PRFDX include:

- Attractive Yield: PRFDX offers a competitive yield, making it ideal for income-focused investors.

- Active Management: The fund is actively managed, with a focus on value investing and undervalued dividend-paying stocks.

- Dividend Growth: T. Rowe Price’s investment approach prioritizes companies with a history of increasing dividends, potentially providing growing income over time.

- Fidelity Contrafund (FCNTX)

Morningstar Rating: ★★★★★

The Fidelity Contrafund is a growth-focused mutual fund that has consistently outperformed its peers. This fund seeks long-term capital appreciation by investing in a diversified portfolio of growth stocks. Key benefits of FCNTX include:

- Proven Track Record: The fund is managed by a team with a strong track record in selecting growth stocks.

- Diversification: FCNTX provides exposure to a wide range of sectors, including technology, healthcare, and consumer discretionary.

- Active Management: The fund’s active management style allows for flexibility in seizing opportunities in the market.

- Dodge & Cox International Stock Fund (DODFX)

Morningstar Rating: ★★★★★

For investors looking to diversify their portfolio with international exposure, the Dodge & Cox International Stock Fund is a top-rated choice. This fund invests in a variety of non-U.S. stocks, offering global diversification and growth potential. Key benefits of DODFX include:

- Value Investing: The fund employs a value-oriented approach, focusing on stocks that are undervalued relative to their intrinsic worth.

- Experienced Management: Dodge & Cox has a long history of successful international investing, offering investors a wealth of expertise.

- Diversification: DODFX invests in companies across various countries and sectors, mitigating concentration risk.

- PIMCO Income Fund (PONAX)

Morningstar Rating: ★★★★★

Income-seeking investors looking for a fixed income option may consider the PIMCO Income Fund. This fund provides exposure to a diversified mix of fixed income securities, making it an attractive choice for those in search of stable income. Key benefits of PONAX include:

- Income Generation: PONAX offers an attractive yield, making it a dependable choice for income generation.

- Experienced Management: The fund is managed by PIMCO, a globally recognized leader in the fixed income space.

- Broad Asset Coverage: PONAX invests in a variety of fixed income securities, including government bonds, corporate bonds, and mortgage-backed securities.

Conclusion

Selecting the right mutual funds is essential for constructing a successful investment portfolio. The five five-star mutual funds mentioned above offer diverse options for investors with varying goals and risk tolerances. These funds provide a range of benefits, from low costs and diversification to active management and income generation. However, it’s crucial for investors to conduct their own research and consider their individual investment objectives and time horizons before making investment decisions. By carefully selecting top-rated mutual funds that align with your financial goals, you can build a well-balanced and profitable portfolio.