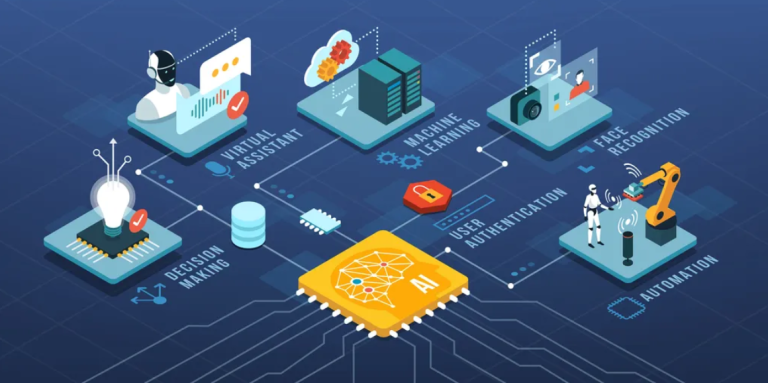

Financial literacy is a vital skill in today’s world, and it’s never too early to start learning about money. One essential aspect of financial education that often goes overlooked is investing. Teaching kids about investing can instill valuable life lessons, shape their financial future, and empower them to make informed decisions. In this article, we’ll explore why you should introduce your children to the world of investing and how to go about it.

The Benefits of Teaching Kids Investing

Financial Literacy: Teaching kids about investing familiarizes them with financial concepts, such as saving, budgeting, and compound interest, at an early age. This knowledge will serve them well throughout their lives.

Long-Term Perspective: Investing encourages a long-term perspective. Kids who learn to invest understand that financial goals require patience and discipline, vital skills in today’s fast-paced world.

Risk Management: Investing introduces children to the idea of risk and reward. It helps them comprehend that all investments carry some level of risk, and they learn how to manage it wisely.

Math and Analytical Skills: Investing involves mathematics and analytical thinking. It challenges kids to use critical thinking and problem-solving skills, enhancing their cognitive development.

Entrepreneurial Spirit: Investing can ignite entrepreneurial ambitions. Kids might become interested in starting their own businesses or exploring innovative ideas as they learn about the companies they invest in.

Financial Security: A strong foundation in investing can set your children on the path to financial security. They may be better prepared to navigate financial challenges and achieve their goals.

How to Teach Kids Investing

Start Early: Begin teaching your kids about money and investing at an age-appropriate level. Simple concepts like saving in a piggy bank can evolve into discussions about investing in stocks and bonds as they grow.

Use Real-Life Examples: Make investing relatable by discussing companies they know and products they use. Show them how their favorite brands can be part of their investment portfolio.

Interactive Learning: Engage your children in hands-on activities. Open an investment account for them and let them choose stocks or mutual funds to invest in (with your guidance).

Set Goals: Help your kids set financial goals. Whether it’s saving for a toy, a bicycle, or college, having goals provides motivation and purpose.

Educational Resources: Utilize educational resources designed for kids. Books, games, and online platforms can make learning about investing fun.

Regular Check-Ins: Review their investments together regularly. This will help them understand how their investments perform and the impact of market fluctuations.

Diversification: Teach the importance of diversification by explaining that they should not put all their money into a single investment. Diversification can help reduce risk.

Encourage Questions: Create an environment where your children feel comfortable asking questions about investing. Address their queries and concerns patiently.

Investing vs. Saving

It’s important to distinguish between investing and saving when teaching kids about finances:

Saving: Saving is the act of setting aside money for future use. Kids can save their allowance or money received as gifts in a piggy bank or a savings account.

Investing: Investing involves putting money into assets with the expectation of generating a return, typically higher than a regular savings account. Investing carries a level of risk, but it also offers the potential for greater rewards.

While saving is essential for short-term goals and emergencies, investing is about growing wealth over the long term.

Teaching the Value of Patience

One of the most valuable lessons kids can learn from investing is the power of patience. Explain that investments can grow over time, but it’s important not to get discouraged by short-term market fluctuations. The ability to wait and stick to a long-term plan is a valuable attribute for both investing and life.

Teaching kids about investing is a gift that can shape their financial future and equip them with essential life skills. By introducing them to the world of finance and investment at a young age, you empower them to make informed decisions, cultivate a long-term perspective, and foster an entrepreneurial spirit. Remember, the journey of teaching kids about investing is an ongoing one that can help them achieve financial security and success in adulthood.