The ongoing debate between Bitcoin and gold as the ultimate safe haven asset has captured the attention of investors and economists alike. Historically, gold has been the go-to asset for hedging against economic uncertainty. But in recent years, Bitcoin has emerged as a contender for the title of the new safe haven. In this article, we’ll explore the attributes of both assets and assess whether Bitcoin could indeed replace gold.

- The Allure of Gold: A Time-Tested Store of Value

Gold has been a symbol of wealth and value for centuries. It offers intrinsic value, is universally accepted, and is resistant to inflation. These factors have cemented its status as a safe haven asset.

- The Rise of Bitcoin: Digital Gold

Bitcoin, often referred to as “digital gold,” shares some similarities with its physical counterpart. It’s a decentralized, deflationary digital asset, immune to the control of central banks, making it an attractive option for investors seeking an alternative to traditional currencies.

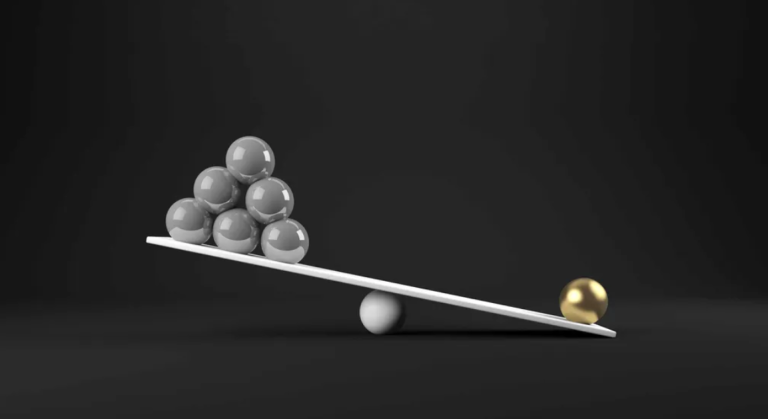

- Scarcity: Gold vs. Bitcoin

Both assets are limited in supply, which drives their value. Gold’s scarcity is a result of geological factors, while Bitcoin’s scarcity is algorithmically programmed. Bitcoin’s fixed supply of 21 million coins is seen by some as a more predictable and transparent form of scarcity.

- Accessibility: Digital Advantage

Bitcoin’s digital nature makes it easily accessible to anyone with an internet connection. This accessibility is a significant advantage, especially for those in regions with limited access to traditional financial systems.

- Portability: Bitcoin’s Global Advantage

Bitcoin’s portability shines when compared to gold’s physical bulk. Transferring large sums of gold across borders can be cumbersome and expensive, while Bitcoin can be moved instantly, regardless of the distance.

- Volatility: Bitcoin’s Achilles’ Heel

Bitcoin’s volatility has been a major point of contention. While its price can soar, it can also plummet. Gold, in contrast, has historically demonstrated stability. This volatility makes Bitcoin a risky choice for conservative investors.

- Security: Gold vs. Digital Wallets

Both assets have their security challenges. Gold must be physically safeguarded, while Bitcoin requires digital wallet security measures. High-profile crypto hacks have raised concerns about the safety of digital assets.

- Trust and Perception: Gold Holds the Historical Advantage

Gold benefits from centuries of trust and global recognition. Bitcoin, on the other hand, is still a relatively new entrant and faces skepticism from traditional investors.

- Correlation: Gold and Bitcoin as Portfolio Diversifiers

Some investors view both gold and Bitcoin as diversification tools. Their low correlation with traditional assets can help hedge portfolios during economic uncertainties.

- The Future of Safe Havens: Can Bitcoin Replace Gold?

While Bitcoin has gained significant traction as a potential safe haven asset, it’s essential to remember that both gold and Bitcoin have distinct advantages and disadvantages. The future may not be a competition between the two but rather a synergy. Investors may incorporate both into their portfolios to diversify and mitigate risk.

- Conclusion: Safe Havens in a Changing World

In an era of economic uncertainty and evolving financial landscapes, the role of safe haven assets remains crucial. Gold’s historical reliability and universal recognition make it an enduring choice. However, Bitcoin’s digital innovation and potential for rapid gains have earned it a prominent place in the discussion. The ultimate decision between these two assets may come down to personal investment goals, risk tolerance, and time horizons. While Bitcoin may not fully replace gold, it is undoubtedly a noteworthy contender in the quest for the new safe haven.