Decentralized Finance, commonly known as DeFi, is a financial revolution that’s reshaping the traditional banking and financial landscape. It leverages blockchain technology to provide open, permissionless, and decentralized financial services. To navigate this evolving world, it’s essential to educate yourself on DeFi thoroughly. In this article, we’ll outline a comprehensive guide on how to educate yourself about DeFi.

- Start with the Basics: What is DeFi?

Begin your journey by understanding the fundamental concepts. DeFi refers to the ecosystem of blockchain-based financial services that includes lending, borrowing, trading, and more. Study the key terms such as smart contracts, decentralized applications (DApps), liquidity pools, and yield farming.

- Online Courses and Tutorials

Many platforms offer free and paid online courses about DeFi. Websites like Coursera, edX, and YouTube are excellent sources. These courses often cover DeFi protocols, how they work, and potential use cases. Take advantage of these resources to build a solid foundation.

- Read Books and Whitepapers

Books and whitepapers provide in-depth insights into DeFi. Explore titles like “Mastering DeFi: A Beginner’s Guide to Understanding Decentralized Finance” by Chris Henry. Dive into the whitepapers of popular DeFi projects like Compound, MakerDAO, and Uniswap. They offer a deep understanding of specific protocols.

- Engage with Online Communities

Join DeFi-focused communities on platforms like Reddit, Telegram, and Discord. Participate in discussions, ask questions, and learn from experienced enthusiasts. DeFi communities are excellent places to stay updated on the latest trends, news, and potential pitfalls.

- Follow DeFi News Outlets

Stay informed by following reputable DeFi news outlets like DeFi Pulse, The Defiant, and CoinDesk. These platforms provide daily updates on the latest developments, hacks, regulations, and market insights. Subscribing to their newsletters is a great way to receive curated content.

- Podcasts and Webinars

Listen to podcasts and attend webinars related to DeFi. Podcasts like “Unchained” and “Bankless” feature industry experts and provide valuable insights. Webinars often host discussions on the most recent DeFi trends and allow direct interaction with experts.

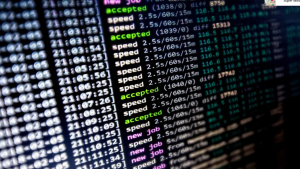

- Try DeFi Platforms (with Caution)

Hands-on experience is crucial. Open a wallet and experiment with small transactions on DeFi platforms. Start with well-established platforms like Compound, Aave, or Uniswap. Be cautious and learn to manage risks. Never invest more than you can afford to lose.

- Learn about Security

Security is paramount in DeFi. Educate yourself about best practices for securing your assets. Understand the risks associated with smart contracts and the importance of using hardware wallets. Explore platforms like DeFi Safety to check the security of various projects.

- Understand Risk Management

Risk management is a critical aspect of DeFi. Study concepts like impermanent loss, slippage, and liquidation. Learn how to use risk management tools and protocols that offer protection, such as hedging strategies and stablecoins.

- Keep Up with Regulatory Developments

DeFi operates in a rapidly changing regulatory environment. Stay informed about cryptocurrency regulations in your country and worldwide. Follow updates from organizations like the Financial Action Task Force (FATF) and the U.S. Securities and Exchange Commission (SEC).

DeFi is a dynamic and ever-evolving field, and self-education is the key to success. By mastering the basics, exploring resources, and actively participating in the DeFi community, you can navigate this exciting financial frontier safely and effectively. Remember that DeFi carries risks, and thorough education is your best defense against potential pitfalls. Stay curious, stay informed, and continue to adapt as this transformative technology matures.