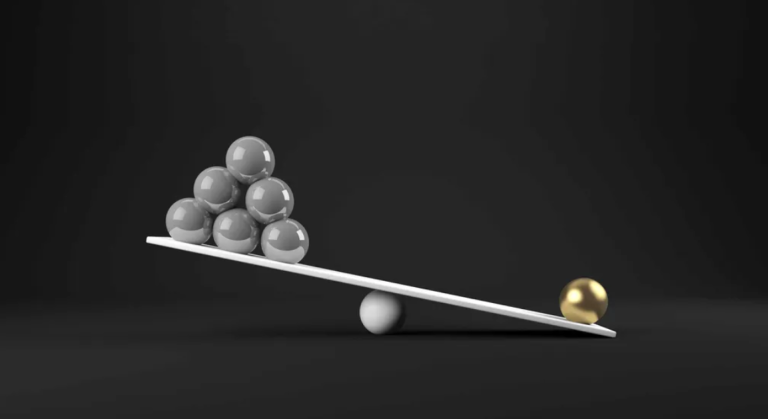

Investing is often about striking a balance between your current financial needs and securing your financial future. While short-term investments can generate quick gains, long-term investments can build wealth steadily over time. In this article, we’ll explore the concept of long-term investment stocks, why they are crucial for financial security, and which stocks might be the best choices for those seeking lasting financial growth.

Understanding Long-Term Investment Stocks

Long-term investment stocks are equities that are held for an extended period, typically several years or even decades. Investors choose these stocks to harness the power of compound interest, stock appreciation, and dividend reinvestment to accumulate wealth over time.

Key Characteristics of Long-Term Investment Stocks

To identify the best long-term investment stocks, it’s essential to understand the characteristics that set them apart:

**1. Stability: Long-term investment stocks often come from well-established companies with a history of financial stability. These companies have durable business models, competitive advantages, and strong market positions.

**2. Growth Potential: The best long-term investment stocks offer growth potential, which can come from various sources, such as expanding into new markets, launching innovative products, or acquiring complementary businesses.

**3. Dividend Payments: Some long-term investment stocks pay dividends, which provide investors with a regular income stream. Reinvesting these dividends can significantly boost returns over time.

**4. Resilience in Market Volatility: These stocks tend to weather market downturns better than riskier, short-term investments. Their ability to maintain value during volatile periods is a valuable trait for long-term investors.

**5. Capital Appreciation: The primary goal of long-term investing is to benefit from the appreciation of stock value. Over the years, as the stock price increases, investors see significant capital gains.

Why Long-Term Investment Stocks Matter

Long-term investment stocks play a vital role in securing your financial future. Here are some compelling reasons why they are crucial:

**1. Wealth Accumulation: Over the long term, the power of compound interest can significantly increase the value of your investments. Your money grows not just on your initial capital but also on the returns it generates.

**2. Retirement Planning: Long-term investments are a cornerstone of retirement planning. They provide a source of passive income and financial security during your retirement years.

**3. Stability: Holding long-term investment stocks can offer stability during market fluctuations, reducing the impact of short-term market volatility on your portfolio.

**4. Tax Benefits: In many jurisdictions, long-term investments are subject to more favorable tax treatment. This can help you keep more of your returns.

**5. Passive Income: Stocks that pay dividends provide a consistent source of passive income, making them an attractive choice for retirees or anyone seeking additional income.

Best Long-Term Investment Stocks

Selecting the best long-term investment stocks requires careful analysis. While individual investment goals and risk tolerance play a significant role, here are some categories and examples of stocks to consider:

**1. Technology Giants: Companies like Apple, Amazon, and Microsoft have demonstrated strong growth potential, innovation, and resilience, making them attractive for long-term investors.

**2. Healthcare Leaders: Pharmaceutical companies with a history of producing vital drugs and medical advancements, such as Johnson & Johnson or Pfizer, offer growth and stability.

**3. Consumer Staples: Companies like Procter & Gamble, with a range of essential consumer products, are known for their defensive qualities and consistent dividends.

**4. Dividend Aristocrats: These are companies that have consistently increased their dividends for at least 25 years. Examples include The Coca-Cola Company, PepsiCo, and ExxonMobil.

**5. Sustainable Energy: As the world shifts towards sustainable energy sources, companies in the renewable energy sector like Tesla and NextEra Energy have promising long-term growth potential.

**6. Real Estate Investment Trusts (REITs): These investments provide an opportunity to own income-generating real estate assets, such as those offered by well-established REITs like Realty Income Corporation and Simon Property Group.

**7. Financial Institutions: Some of the most stable and dividend-yielding stocks belong to financial institutions like JPMorgan Chase and Bank of America.

Investor Strategies for Long-Term Success

To maximize the potential of long-term investment stocks, consider these strategies:

**1. Diversification: Spread your investments across different sectors and industries to reduce risk and enhance portfolio stability.

**2. Regular Monitoring: Keep an eye on your investments, reviewing your portfolio’s performance and adjusting it as needed.

**3. Long-Term Perspective: Avoid reacting to short-term market fluctuations. Instead, focus on your long-term goals.

**4. Reinvestment: Reinvest dividends and returns to take full advantage of the power of compounding.

**5. Professional Guidance: If you’re uncertain about your investment strategy, consider consulting a financial advisor who can offer personalized guidance.

Long-term investment stocks are a cornerstone of financial security and wealth building. They offer the potential for significant growth, stability, and passive income. By selecting the best long-term investment stocks, maintaining a long-term perspective, and following sound investment strategies, you can build a financial future that is both secure and prosperous.